Research & Learning

Search for catalytic capital data, analysis, case studies and market development tools that can help investors identify opportunities for impact around the world.

- Investor Networks

- Climate

- Global

This new issue brief from The Global Impact Investing Network (GIIN) provides a framework for private institutional investors who aim to address climate challenges through their capital. “By making use of targeted catalytic capital and other strategies, these investors can help make significant progress towards global decarbonization targets by accelerating the build-out of climate infrastructure in emerging markets,” the authors write.

- Strengthening the Evidence Base

- Multi-Sector Research

- Global

A report from the Impact Finance Research Consortium (IFRC) sheds new light on the features and applications of catalytic capital. A collaboration of the Wharton ESG Initiative, the Harvard Business School Social Impact Collaboratory, and the Rustandy Center for Social Sector Innovation at Chicago Booth, IFRC analyzed when, how, and why impact investors deploy catalytic capital and reports on recommendations for building the field of catalytic capital in the future.

- Investor Networks

- Multi-Sector Research

- Europe

In a new white paper, EVPA, one of C3’s network partners, takes a close look at how impact investors can be more catalytic in their provision of capital, in pursuit of impact for people and planet. “Funding is not flowing to transformational solutions at the accelerated rate most impact capital providers had hoped for; what we’re doing isn’t working fast enough. How can we mobilise more capital to fund a fair and green society that works for all? Can the rate of our transformation match our aspirations?”

- Investor Networks

- Agriculture, Education, Health, Multi-Sector Research

- India

AVPN offers an overview of the work of Artha Impact, an advisory firm that facilitates deployments of patient capital, with a goal of investing in early-growth stage high-impact businesses in India that focus on underserved communities. Artha Impact supports the development and the de-risking of businesses that can scale and raise millions of dollars further down the line and eventually attract larger equity investors.

- Strengthening the Evidence Base

- Entrepreneurs, Gender Equity, SMEs/SGBs

- India, South Asia

Mumbai-based 200 Million Artisans researched the impact of catalytic capital on India’s Creative Manufacturing and Handmade (CMH) sector. Surveying entrepreneurs, it concluded that “the right financing at the right time, right place, and right terms” can help the CMH sector catalyse 200 million livelihoods as well as large-scale gender inclusion, while also advancing positive climate action.

- Strengthening the Evidence Base

- Entrepreneurs, Racial Equity, SMEs/SGBs, Social Justice

- North America, United States

First Peoples Worldwide (FPW) studied the role that catalytic capital plays in “forwarding self-determination and non-extractive investing” for Indigneous Peoples in the United States. “Native Peoples have built economic power; Native businesses are flourishing; and there are ample opportunities to fund successful Native enterprises both on and off reservations,” according to the new report, Indigenizing Catalytic Capital.

- Strengthening the Evidence Base

- Financial Inclusion

- Global

In an insightful report, the Center for Financial Inclusion (CFI) focuses on the role of catalytic capital as a force multiplier for investments in the digital credit industry. The paper draws lessons from how digital credit markets have evolved, driven by initial catalytic capital investments that spurred further investments, and highlights guardrails needed at the market level to ensure that growth is responsible, impactful, and leads to inclusive market development.

- Strengthening the Evidence Base

- Affordable Housing, Community Development/Place-based Investing

- Europe

New research from Periféria Policy and Research Center looks at the potential of catalytic capital investments in the housing sector of Central and South-Eastern Europe (CSEE), where housing has become increasingly unaffordable. The report focuses on housing markets in Bosnia and Herzegovina, Bulgaria, Czechia, Croatia, Hungary, Northern Macedonia, Serbia, and Slovenia. It also considers the need for investment in sustainable housing solutions to address the climate crisis. C3 funded the research through its Strengthening the Evidence Base workstream.

- Advancing Practice

- Multi-Sector Research

- Global

Catalytic capital plays a vital “sustaining” role for funds, initiatives, and enterprises that take on the world’s most difficult challenges. This is the third and final guidance note to emerge from the C3 Learning Lab series, detailing how, when, and why investors seek out these kinds of opportunities.

- Strengthening the Evidence Base

- Agriculture, Health, SMEs/SGBs

- Africa, Sub-Saharan Africa

From Open Capital Advisors, a “Voices from the Field” report highlights the experience of small and growing businesses in sub-Saharan Africa, focusing particularly on agriculture and health care and the underlying challenges that have left a $96 billion funding gap in those sectors. C3 funded this research as part of our Strengthening the Evidence Base workstream.

- Strengthening the Evidence Base

- SMEs/SGBs

- Africa, Sub-Saharan Africa

From Ashesi University and Impact Investing Ghana, new research details how patient, long-term catalytic capital has been deployed in Ghana’s small and medium enterprises (SME) financing sector. C3 funded this research as part of our Strengthening the Evidence Base workstream.

- Strengthening the Evidence Base

- Racial Equity, Social Justice

- North America

New Growth Innovation Network (NGIN) elevates key insights about racial wealth gaps. Some key takeaways: racialized definitions of risk continue to hold back capital; 2020 financial commitments can mostly be viewed as market corrections rather than catalytic; and there is evidence of catalytic capital investments that can be scaled. C3 funded the research as part of our Strengthening the Evidence Base workstream.

- Investor Networks

- Education, Health

- Europe

EVPA highlights the work of Rethink Ireland, which invests in Irish social enterprises, and its support for Sensational Kids, a nonprofit that provides therapeutic support to children with special educational needs. Rethink Ireland provided funding and organizational development support that built the capacity of Sensational Kids and attracted financing for a new National Child Development Centre.

- Strengthening the Evidence Base

- Agriculture

- Africa, Sub-Saharan Africa

In it’s Year 2 Learning Report, Aceli Africa reflects on its engagement with lenders in support of 713 loans totaling $85 million to agri-SMEs across Kenya, Rwanda, Tanzania, and Uganda. C3 supported this work as part of our Strengthening the Evidence Base workstream.

- Investor Networks

- Education, Energy Efficiency, Multi-Sector Research, Social Justice

- Africa, Asia

The Merry Year Social Company (MYSC) is a South Korea-based impact investor focused on early-stage social venture companies that do not have access to mainstream investors. In a 2023 case study, AVPN offers an overview of the firm’s investments in sectors such as job creation, eldercare, STEM education, and energy innovation in both Asia and Africa.

- Investor Networks

- Entrepreneurs, SMEs/SGBs, Social Justice

- Middle East/North Africa

Convergence, the blended finance network, takes a deep dive into the development of Refugee Impact Bonds by KOIS, a global impact investing firm (and C3 grantee). Proceeds are financing a four-year microenterprise training and grants program focused on businesses for refugees and host communities in Jordan and Lebanon.

- Advancing Practice

- Multi-Sector Research

- Global

- Investor Networks

- Recycling/Upcycling, SMEs/SGBs

- Middle East/North Africa

Alfanar is a venture philanthropy organization working in Egypt, Lebanon and Jordan to advance the work of high-impact organizations. In a 2023 case study, EVPA looks at Alfanar’s support for FabricAid, a social enteprise focused on the apparel industry, which has been able to scale its operations thanks to catalytic capital and management support.

- Strengthening the Evidence Base

- Entrepreneurs

- Sub-Saharan Africa

This joint effort from the Initiative for Blended Finance at the University of Zurich, the Bertha Centre at the University of Cape Town Graduate School of Business, and Roots of Impact analyzes catalytic capital and blended finance from the perspective of the entrepreneur. C3 funded the research as part of our Strengthening the Evidence Base workstream.

- Advancing Practice

- Multi-Sector Research

- Global

This is the first in a series of guidance notes emerging from C3 Learning Labs with seasoned catalytic capital investors. It identifies some of the challenges investors may face when deploying catalytic capital in a “seeding” role and details best practices for the field. The Learning Labs and guidance note is part of C3’s Advancing Practice workstream.

- Advancing Practice

- Multi-Sector Research

- Global

Still wondering about the how, when, and why of catalytic capital? You’re not alone. C3 addresses some of the key questions about the sector and why it is so critical to achieving social and environmental impact.

- Research from the Field

- SMEs/SGBs

- Africa

There is a shortage of growth capital for small and growing businesses (SGBs) in African markets, which could be partially filled by local institutional investors, particularly local pension funds. In this report, the Collaborative for Frontier Finance highlights the work of market builders working closely with pension fund industry bodies to unlock capital for small business finance in Africa.

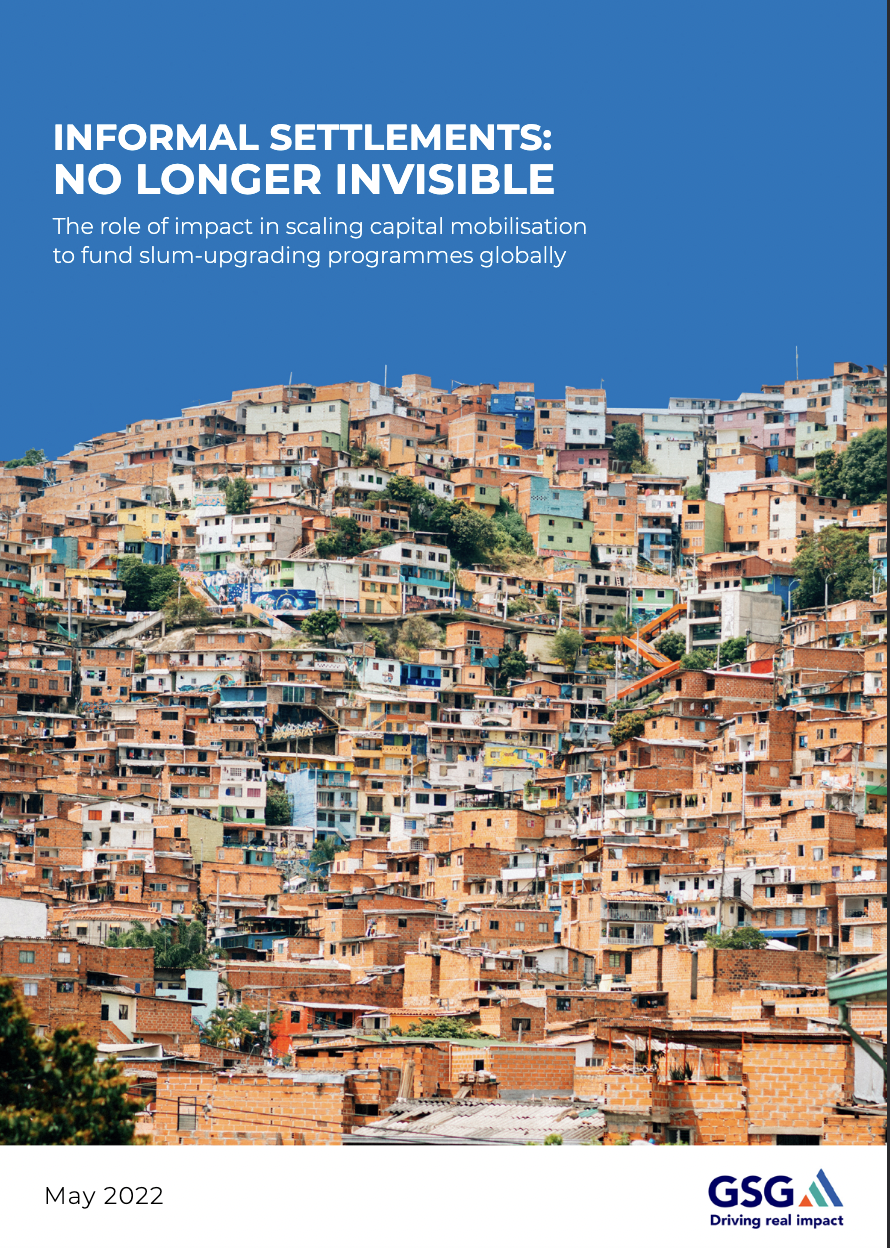

- Fostering Solutions and Infrastructure

- Urban Informality/Informal Settlements

- Global

More than 1 billion people live in slums and informal settlements across the Global South. In a ground-breaking report, the Global Steering Group for Impact Investment (GSG Impact) makes the case for prioritizing urban informality as a

core area for impact and development and emphasizes the contribution this would make to achieving the UN Sustainable Development Goals.

- Investor Networks

- Climate, Energy Efficiency

- Latin America, South America

Convergence, the blended finance network, analyzed the Government of Uruguay’s 200MW tender program, launched in 2013, to attract private sector participation in the development of solar photovoltaic (PV) power plants and increase the share of renewable energy in Uruguay’s energy matrix. IDB Invest and the Canadian Climate Fund for the Private Sector in the Americas (C2F) addressed the primary market barriers to institutional investor investment in Uruguay’s nascent solar market. Their joint participation reduced counterparty risk and improved project bankability.

Banner Photo: Sustainable forestry, Rwanda/courtesy of Total Impact Capital.